Southwest Gas Mails Letter to Stockholders on Comprehensive Strategic Alternatives Process to Unlock Maximum Value

Believes There Will Be Significant Interest in Southwest Gas

Urges Stockholders to Vote the WHITE Proxy Card to Support Southwest Gas Board to Oversee the Strategic Alternatives Process and Maximize Value for All Southwest Gas Stockholders

LAS VEGAS, April 25, 2022 /PRNewswire/ -- Southwest Gas Holdings, Inc. (NYSE: SWX) ("Southwest Gas" or the "Company") today announced it is mailing a letter to its stockholders in connection with its upcoming Annual Meeting of Stockholders (the "Annual Meeting"), scheduled for May 12, 2022.

The Board strongly recommends that stockholders vote "FOR ALL" its director nominees on the WHITE proxy card promptly upon receipt. The proxy materials and other information regarding the Board of Directors' recommendation for the 2022 Annual Meeting can be found at www.SWXBuildingValue.com.

Stockholders who have questions or who need help voting their shares may call the Company's proxy solicitor, Innisfree M&A Incorporated, at 1 (877) 825-8621 (toll-free from the U.S. and Canada) or +1 (412) 232-3651 (from other countries).

The full text of the letter being mailed to stockholders follows:

Vote the WHITE Proxy Card to Support Comprehensive Strategic Alternatives Process to

Unlock Maximum Value of Southwest Gas

April 25, 2022

Dear Fellow Southwest Gas Stockholder,

Your Board is focused on maximizing stockholder value. That is why we rejected an inadequate $82.50 per share tender offer (the "Offer") from Carl Icahn ("Mr. Icahn"). It is also the reason that, following the receipt of an indication of interest well in excess of Mr. Icahn's Offer, we unanimously determined that now is the time to commence a process to review all strategic alternatives available to maximize value for all Southwest Gas stockholders (the "process"). The alternatives include a sale of the Company, or a separate sale of its business units, or our previously announced plan to spin-off Centuri.

A VOTE FOR THE ICAHN CONTROL SLATE IS A VOTE FOR MR. ICAHN'S INADEQUATE TENDER OFFER

As we conduct this process, it would be contrary to the interests of Southwest Gas stockholders to have nominees that Mr. Icahn selected as part of the Board of Directors. Indeed, Mr. Icahn assembled his control slate of nominees specifically to take control of the Board and further his agenda. He said so himself.

In addition, you cannot reconcile Mr. Icahn extending his inadequate and illusory tender offer with the statements he made in his April 21, 2022 open letter to stockholders. Mr. Icahn stated: "To be clear, we [Icahn Enterprises] will not participate (that is, we will not be a bidder) in the purported "strategic review" process run by either the incumbent board or our new and improved board." We strongly believe it is in the best interests of stockholders to vote the WHITE proxy card to support the Southwest Gas value maximization process, and to reject Mr. Icahn's control slate, which he has made clear has been assembled solely to facilitate his efforts to take control of the Company at an inadequate price, which is well below our current stock price. In fact, Mr. Icahn publicly stated, "at the very least, a majority of the Board needs to change in order to allow for the tender offer to be completed".

Despite the confusion created by Mr. Icahn's contradictory actions, our invitation for Mr. Icahn to participate in the process remains open.

Our highly experienced Board is conducting this process thoroughly and expeditiously. Members of the Southwest Gas Board of Directors have participated in numerous highly successful public company sale processes in various professional capacities. In fact, two Southwest Gas directors, Jane Lewis-Raymond and Leslie T. Thornton, served in prominent executive leadership roles for two of the most successful sale transactions in the gas utility industry, the sale of Piedmont Natural Gas Company, Inc. to Duke Energy Corporation, and the sale of WGL Holdings, Inc. to AltaGas Ltd., respectively. Your Board's extensive transaction experience, together with its broad and deep regulatory expertise and experience in the utility, construction and other relevant industries, make it the right Board to get the best possible value for stockholders.

The Board has formed a dedicated Strategic Transactions Committee composed solely of independent directors, Anne Mariucci, Carlos Ruisanchez and Jane Lewis-Raymond, to drive the review process. These directors have strong capital markets, regulatory and M&A experience. Our financial advisor has already begun discussions with interested parties and we have directed our financial advisor to begin making outbound calls to other interested parties. Again, regardless of Mr. Icahn's misleading public commentary, we are also reaching out to him to encourage his participation in the process.

We have already received additional inbound interest and we believe there will be significant interest in Southwest Gas.

We urge you to vote the WHITE proxy card to ensure that stockholders receive the maximum value for their shares by allowing your Board to conduct this review process as expeditiously and effectively as possible.

STRATEGIC ALTERNATIVES PROCESS MAXIMIZES VALUE OF SOUTHWEST GAS' SUCCESSFUL

TRANSFORMATION TO UNLOCK STOCKHOLDER VALUE

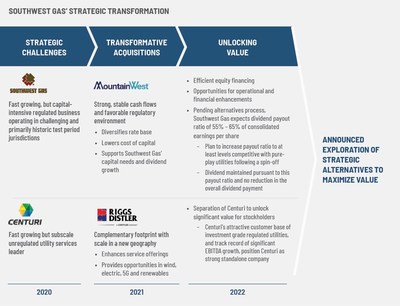

Your Board and management team have taken a series of actions in the last several years to enhance the value of our regulated and unregulated businesses and to unlock that value for stockholders. The strategic alternatives process is the culmination of this strategic transformation.

ANALYSTS AGREE THAT OUR "STRATEGIC REVIEW IS A GAME CHANGER"

Industry experts recognize that there is significant value to be unlocked in both our regulated and unregulated businesses through this process.

One analyst noted:

Strategic Review is Game Changer

The announcement of the strategic review of the company, and a new higher bidder pushes the investment debate much more to the sum of the part valuation which precedent transactions for the three components suggest robust interest in LDCs and construction businesses. We are incremental much more positive on the stock.

– Citi Equity Research, 18 April 20221

SOUTHWEST GAS HAS THE RIGHT BOARD TO OVERSEE THE STRATEGIC ALTERNATIVES PROCESS

We strongly believe that Southwest Gas has the right Board to oversee the value maximization process. Your refreshed Board is made up of highly qualified, independent, engaged and diverse directors with strong industry experience, and expertise in strategy, finance, ESG, legal/regulatory and M&A. Your Board also includes leaders that work and live in Southwest Gas' service jurisdictions, which is important to Southwest Gas' regulators.

Southwest Gas has a robust and ongoing Board refreshment process to ensure the Board is composed of individuals with varied, complementary backgrounds, who possess core competencies that enhance our oversight and support our strategy.

Through this process, we have refreshed 40% of our Board in the last three years, adding four highly qualified Directors to our Board since 2019, three of whom are seasoned leaders in our industry and all of whom bring specific and extensive relevant M&A expertise.

We remain committed to evaluating all meaningful opportunities to maximize value for all of our stockholders – and continuing to lead with governance best practices.

PROTECT THE VALUE OF YOUR SOUTHWEST GAS INVESTMENT:

VOTE THE WHITE PROXY CARD TODAY

We welcome and encourage Mr. Icahn's participation in the process; however, we strongly believe that it would be against the best interests of Southwest Gas stockholders to permit Mr. Icahn's handpicked nominees to oversee the Company and the process.

Electing any of the nominees on Mr. Icahn's control slate could have a chilling effect on the process and potentially dissuade other parties from participating. Any of Mr. Icahn's nominees would be inherently conflicted. If elected to the Southwest Gas Board, Mr. Icahn's nominees would be in a position to advance his agenda and influence the outcome of the process.

Despite the fact we have received an indication of interest well in excess of Mr. Icahn's $82.50 per share offer, authorized a strategic alternatives process and invited him to participate, Mr. Icahn continues to run his proxy contest in an attempt to take control of the Board. Conversely, the Southwest Gas Board is committed to maximizing the value of the Company for all stockholders.

We believe the process is best overseen by the Southwest Gas Board of Directors and its independent Strategic Transactions Committee, not Mr. Icahn's nominees and deputies who have been put forward to allow him to take control of the Company.

This is a critical moment for Southwest Gas and your investment in the Company. We are confident that our ongoing strategic alternatives process will maximize value for all of our stockholders.

On behalf of your Board and the management team, thank you for your continued support.

Sincerely,

|

/s/ Michael J. Melarkey |

/s/ Robert L. Boughner |

|

Michael J. Melarkey |

Robert L. Boughner |

|

Chairman |

Incoming Chairman |

|

YOUR VOTE IS IMPORTANT—PLEASE USE THE WHITE PROXY CARD TODAY! |

|

Simply follow the easy instructions on the enclosed WHITE proxy card to vote by telephone, |

|

Remember--please do not vote using any gold proxy card you may receive from Mr. Icahn, |

|

If you have questions about how to vote your shares, please call the firm assisting us with |

Lazard is serving as financial advisor to Southwest Gas and Morrison & Foerster LLP and Cravath, Swaine & Moore LLP are serving as legal advisors.

About Southwest Gas Holdings, Inc.

Southwest Gas Holdings, Inc., through its subsidiaries, engages in the business of purchasing, distributing and transporting natural gas, and providing comprehensive utility infrastructure services across North America. Southwest Gas Corporation, a wholly owned subsidiary, safely and reliably delivers natural gas to over two million customers in Arizona, California and Nevada. The Company's MountainWest subsidiary provides natural gas storage and interstate pipeline services within the Rocky Mountain region. Centuri Group, Inc., a wholly owned subsidiary, is a strategic infrastructure services company that partners with regulated utilities to build and maintain the energy network that powers millions of homes and businesses across the United States and Canada.

How to Find Further Information

This communication does not constitute a solicitation of any vote or approval in connection with the 2022 annual meeting of stockholders of Southwest Gas Holdings, Inc. (the "Company") (the "Annual Meeting"), scheduled to be held May 12, 2022. In connection with the Annual Meeting, the Company has filed a definitive proxy statement with the U.S. Securities and Exchange Commission ("SEC"), which the Company has furnished to its stockholders in connection with the Annual Meeting. The Company may furnish additional materials in connection with the Annual Meeting. BEFORE MAKING ANY VOTING DECISION, WE URGE STOCKHOLDERS TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND WHITE PROXY CARD AND OTHER DOCUMENTS WHEN SUCH INFORMATION IS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE ANNUAL MEETING. The proposals for the Annual Meeting are being made solely through the definitive proxy statement. In addition, a copy of the definitive proxy statement may be obtained free of charge from www.swgasholdings.com/proxymaterials. Security holders also may obtain, free of charge, copies of the proxy statement and any other documents filed by Company with the SEC in connection with the Annual Meeting at the SEC's website at http://www.sec.gov, and at the Company's website at www.swgasholdings.com.

Important Information for Investors and Stockholders: This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. In response to the tender offer for the shares of the Company commenced by IEP Utility Holdings LLC and Icahn Enterprises Holdings L.P., the Company has filed a solicitation/recommendation statement on Schedule 14D-9 with the SEC. INVESTORS AND STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS ARE URGED TO READ THE SOLICITATION/RECOMMENDATION STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a free copy of these documents free of charge at the SEC's website at www.sec.gov, and at the Company's website at www.swgasholdings.com. In addition, copies of these materials may be requested from the Company's information agent, Innisfree M&A Incorporated, toll-free at (877) 825-8621.

Forward-Looking Statements: This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include, without limitation, statements regarding Southwest Gas Holdings, Inc. (the "Company") and the Company's expectations or intentions regarding the future. These forward-looking statements can often be identified by the use of words such as "will", "predict", "continue", "forecast", "expect", "believe", "anticipate", "outlook", "could", "target", "project", "intend", "plan", "seek", "estimate", "should", "may" and "assume", as well as variations of such words and similar expressions referring to the future, and include (without limitation) statements regarding expectations with respect to a separation of Centuri, the future performance of Centuri, Southwest Gas's dividend ratios and Southwest Gas's future performance. A number of important factors affecting the business and financial results of the Company could cause actual results to differ materially from those stated in the forward-looking statements. These factors include, but are not limited to, the timing and amount of rate relief, changes in rate design, customer growth rates, the effects of regulation/deregulation, tax reform and related regulatory decisions, the impacts of construction activity at Centuri, whether we will separate Centuri within the anticipated timeframe and the impact to our results of operations and financial position from the separation, the potential for, and the impact of, a credit rating downgrade, the costs to integrate MountainWest, future earnings trends, inflation, sufficiency of labor markets and similar resources, seasonal patterns, the cost and management attention of ongoing litigation that the Company is currently engaged in, the effects of the pending tender offer and proxy contest brought by Carl Icahn and his affiliates, and the impacts of stock market volatility. In addition, the Company can provide no assurance that its discussions about future operating margin, operating income, COLI earnings, interest expense, and capital expenditures of the natural gas distribution segment will occur. Likewise, the Company can provide no assurance that discussions regarding utility infrastructure services segment revenues, EBITDA as a percentage of revenue, and interest expense will transpire, nor assurance regarding acquisitions or their impacts, including management's plans or expectations related thereto, including with regard to Riggs Distler or MountainWest. Factors that could cause actual results to differ also include (without limitation) those discussed under the heading "Risk Factors" in the Company's most recent Annual Report on Form 10-K and in the Company's and Southwest Gas Corporation's current and periodic reports, including our Quarterly Reports on Form 10-Q, filed from time to time with the SEC. The statements in this press release are made as of the date of this press release, even if subsequently made available by the Company on its Web site or otherwise. The Company does not assume any obligation to update the forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments, or otherwise.

Participants in the Solicitation: The directors and officers of the Company may be deemed to be participants in the solicitation of proxies in connection with the Annual Meeting. Information regarding the Company's directors and officers and their respective interests in the Company by security holdings or otherwise is available in its most recent Annual Report on Form 10-K filed with the SEC and the definitive Proxy Statement on Schedule 14A filed with the SEC in connection with the Annual Meeting. Additional information regarding the interests of such potential participants is included in other relevant materials filed with the SEC.

Contacts

For investor information, contact: Boyd Nelson, (702) 876-7237, boyd.nelson@swgas.com; or Innisfree M&A Incorporated, Scott Winter/Jennifer Shotwell/Jon Salzberger, (212) 750-5833.

For media information, contact: Sean Corbett, (702) 876-7219, sean.corbett@swgas.com; or

Joele Frank, Wilkinson Brimmer Katcher, Dan Katcher / Tim Lynch, (212) 355-4449.

|

1 Permission to use quote neither sought nor obtained. The Company is not endorsing or adopting the contents of the report, and it is not incorporated into this letter. |

SOURCE Southwest Gas Holdings, Inc.